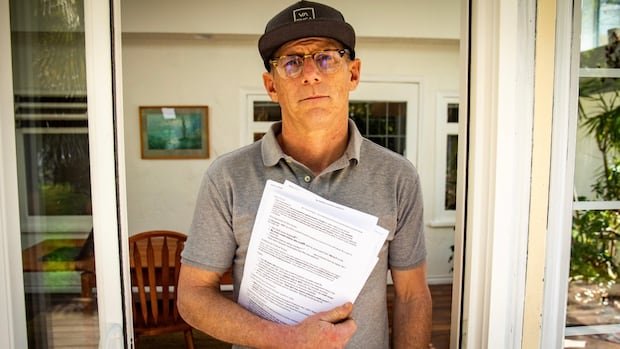

David Tregear encountered unexpected challenges when his credit applications were repeatedly denied after years of easy approvals. His Equifax credit score, which was previously healthy at around 700, suddenly plummeted to zero without any prior notice or explanation, leaving him baffled and frustrated.

Despite numerous attempts to rectify the situation by providing documentation, filing complaints, and seeking assistance from regulatory bodies, Equifax remained unresponsive to Tregear’s pleas until Go Public intervened. It was then revealed that Equifax’s policy includes labeling consumers as “unscoreable” and resetting their credit score to zero if their credit file remains inactive for an extended period, which was the case for Tregear due to his decision to avoid taking on additional debt.

While Equifax attributed the score reset to inactivity, Tregear expressed concern over the severe repercussions as many lenders primarily rely on Equifax for credit assessments. Unlike TransUnion, Equifax enforces the two-year inactivity threshold, but it remains unclear if this policy applies universally.

Geoff White, a consumer advocate, highlighted the lack of oversight in the credit scoring system, emphasizing the significant impact a credit score can have on financial opportunities. He noted that the absence of clear regulations allows credit bureaus to wield considerable power without sufficient transparency.

Tregear’s ordeal navigating various channels for assistance underscored the convoluted and disjointed complaints process in the credit reporting system. Despite reaching out to multiple agencies, including federal and provincial bodies, Tregear found himself caught in a bureaucratic loop with no clear resolution in sight.

The absence of standardized regulations for credit bureaus’ practices and the opaque nature of credit score calculations raised concerns among experts and advocates. White advocated for federal intervention to establish consistent national standards under the Bank Act, aiming to enhance accountability and transparency in the credit reporting process.

Equifax’s silence on transparency issues and the complexities faced by consumers like Tregear in seeking redress highlighted the need for comprehensive reforms in the credit reporting sector. As Tregear continues to grapple with the aftermath of his reset credit score, he emphasized feeling penalized for his responsible financial choices.

Despite regulatory bodies showing interest in investigating Tregear’s case, the overarching challenges posed by Equifax’s policies and the regulatory framework remain unresolved, leaving consumers vulnerable to the repercussions of credit score manipulations.